Manage the Charging for Your Medium- and Heavy-Duty

Electric Fleet and Save Money

By Shuhan Song

CALSTART’s Data Insights & Analytics (DnA) team reviewed medium- and heavy-duty electric truck data from fleets operating throughout the United States and found that charge management can provide substantial energy savings and reduce unnecessary burden on utility infrastructure (U.S. DOE), which translates into lower costs for your fleet.

The DnA team used fleet operations data to model charging schedules for a hypothetical fleet under unmanaged and managed charging scenarios and compared their load profiles and energy costs to illustrate the load control and cost savings benefits from managed charging. We supported our energy use assumptions made for this hypothetical fleet using a machine learning model trained on 26,724 vehicle-days of real-world, medium- and heavy-duty electric vehicle (EV) operation data (CALSTART).

Here’s what we found:

- With managed charging, fleetwide peak load decreases from 200 kW to 150 kW for the hypothetical fleet, a 25% reduction from the unmanaged scenario.

- Managed charging saves the hypothetical fleet $714 per month per vehicle, a 37% reduction from the unmanaged scenario.

- Managed charging allows fleet owners to maximize their savings on operational costs without investing in more infrastructure.

Our Hypothetical Fleet

The hypothetical fleet is composed of four Class 8 day cab battery-electric tractors (BETs) with 422-kWh batteries in each. Four 50-kW DCFCs with 95% efficiency are installed for charging. Each BET travels 110 miles a day, using about 300 kWh of energy at 2.73 kWh/mile energy efficiency.

- Duty cycle: In operation daily between 5 a.m. and 6 p.m.

- Charging: BETs are available to charge overnight from 6 p.m. to 5 a.m. the next morning; BETs opportunity charge between 12 p.m. and 1 p.m. at the depot.

- Rate schedule: PG&E’s Business Electric Vehicles Schedule BEV-2. Two components of a rate schedule can impact a fleet’s variable energy cost: the time-of-use (TOU) rate and the subscription charge with overage fee, where the latter functions similarly to demand charge policies that are employed by some utility providers.

Two Charging Scenarios

We modeled charging schedules of the fleet under two different scenarios: unmanaged and managed charging. We break down the results of the two scenarios by looking at their daily load profiles and monthly energy costs.

| Unmanaged Charging | Managed Charging |

|---|---|

| All BETs are plugged in for charging immediately after returning to depot at 6 p.m. | BETs are staggered to charge at different periods of dwell hours. |

| All BETs are charged at the maximum 50-kW charging rate. | Minimizes peak load of the site. |

| Does not utilize midday charging at noon. | Prioritizes hours with lower TOU rates. |

Load Profile

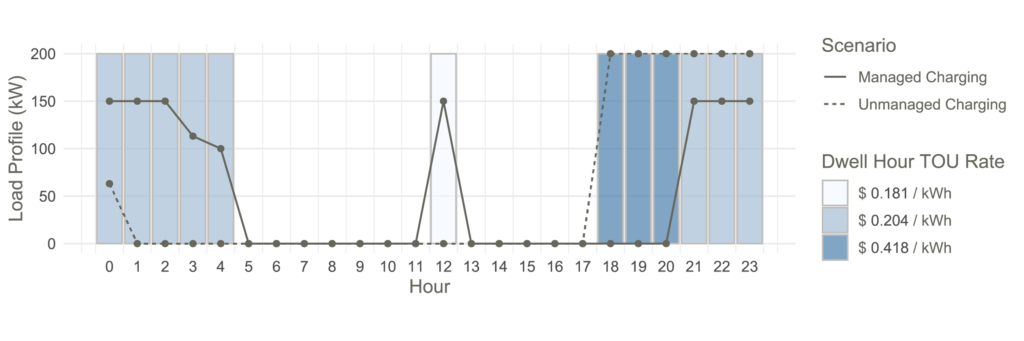

When unmanaged, the four BETs all charge between 6 p.m. and 12 a.m. at their maximum charging rate, resulting in a fleetwide peak load of 200 kW during this time. Hours with the highest rate (6 p.m. to 9 p.m.) are used while the hour with the lowest rate (12 p.m. to 1 p.m.) is not.

In contrast, when charging is managed, fleetwide peak load is controlled at 150 kW, a 25% reduction from the unmanaged scenario. Charging between 6 p.m. and 9 p.m. is avoided, and midday charging is used to take advantage of the lowest rate. The following figure shows the fleetwide load profile of managed (solid line) and unmanaged (dashed line) charging scenarios. The shaded bars represent the dwell time of the BETs with the darker color indicating a higher utility rate.

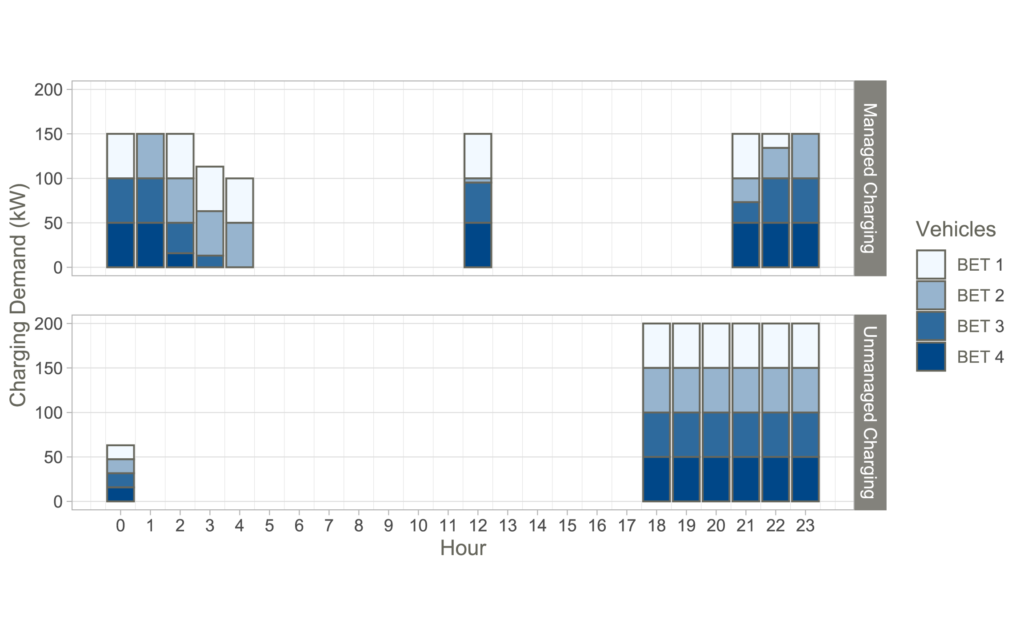

Zooming in at vehicle-level charging of the two charging scenarios in the figure below, we can see BETs are staggered to charge at various rates when managed. For example, BET 2’s charging rate gradually increases from 9 p.m. to 11 p.m. as BET 1’s charging rate tapes off. BET 3 and BET 4’s charging rate decreases from 2 a.m. to 4 a.m. while BET 2 and BET 1 are actively charging at the maximum rate. In contrast, the unmanaged scenario uses the same maximum charging rate for all BETs simultaneously, resulting in a higher fleetwide peak load.

The charging rate will not be a constant value over time in real-world operations. The example here simplified the scenarios for easier understanding of the concept.

Energy Cost

Energy Cost

In our example, managed charging saves the hypothetical fleet $714 per month per BET, a 37% reduction from the unmanaged scenario. Class 8 short-haul diesel trucks can have fuel costs around $0.43 – 0.53/mile (NREL; ICF). With charging management, fleets can reduce energy cost to $0.29/mile and maximize the operational cost savings of their electric vehicles—a top reason to electrify diesel fleets without the need to invest more in other infrastructure.

| Cost Type | Managed Charging | Unmanaged Charging |

|---|---|---|

| TOU Cost | $5,348 | $8,108 |

| Subscription Fee | $287 (three 50-kW blocks) | $382 (four 50-kW blocks) |

| TOU Cost + Subscription Fee | $5,635 | $8,490 |

| TOU Cost + Subscription Fee per BET | $1,409 | $2,123 |

| TOU Cost + Subscription Fee per Mile | $0.290 / mile | $0.436 / mile |

Beyond the Simple Example

Managed charging controls fleetwide load profile, reduces demand peaks, and saves energy costs that altogether maximize the benefits of fleet electrification, making electric fleets more cost effective than diesel fleets.

The managed charging is modeled by CALSTART—DnA’s in-house charging optimization model. In addition to proposing a vehicle-level optimized charging plan and estimating load profiles and energy costs, it can also address the following use cases:

- Optimize charging using any vehicle-to-charger ratio while using multiple charger types for an EV.

- Suggest minimum vehicle battery capacity and minimum energy for midday charging to meet operational requirements.

- Add solar and energy storage systems into the equation.

- Project energy use, energy cost, and emission savings from electrifying a diesel fleet in the next 30 years.

Inquiries are welcome, please contact ssong@calstart.org. Stay connected for more!