Q&A: Unlocking Battery-Electric Truck Financing

As fleet operators consider transitioning to battery-electric trucks (BETs), financing remains one of the biggest hurdles they face. Traditional lenders often hesitate to finance BETs because they’re unsure about residual value: the estimated value of the vehicle at the end of its financing term. But new research suggests that assessing the resale value of individual components, particularly the battery pack, can establish a more accurate and optimistic picture of residual value for BETs—and help lenders provide better financing terms for fleets. Learn more about this innovative approach with Kabir Nadkarni, EV Industry Assessment Specialist at CALSTART, in an insightful conversation below.

Q: Why are lenders hesitant to finance battery-electric trucks?

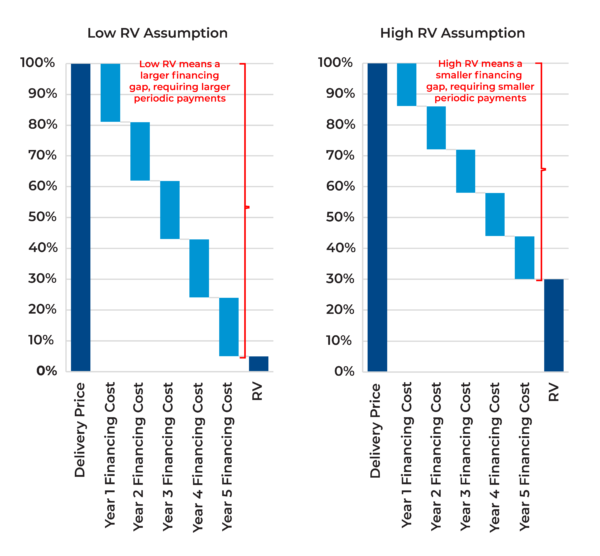

The main issue is uncertainty about residual value. Since BETs are a relatively new asset class with few used models on the road, little historical data is currently available about their resale value. In response, many lenders make extremely conservative assumptions, sometimes assuming the BET’s value will fall to nearly zero early in its financing term. This leads to high periodic payments, making financing unaffordable for many fleets. But CALSTART’s analysis, backed by industry-leading business models championed by our member companies in the zero-emission transportation sector, indicates that conservative assumptions around BET residual values may not hold true.

Impact of Residual Value (RV) on Financing Terms

Source: Battery-Electric Truck Component Resale Highlights Residual Value Upside, 2024

Q: How can we better estimate a BET’s residual value?

Battery second-life projects are actively proving that lenders’ current assumptions fall far below the actual residual value of BETs. Instead of waiting for more resale data on used BETs to accumulate, we can estimate minimum residual value by looking at the resale potential of individual components, particularly:

- The battery pack (50-60% of initial value)

- The structural chassis

- Electric axle components, such as motors and power electronics

This component-based approach provides a concrete minimum value that lenders can rely on, even without extensive resale data. The component method for benchmarking residual values depends on the intrinsic valuation of commodities like batteries, which have a predictable pricing forecast as well as a predictable decrease in state-of-health and capacity based on industry-vetted degradation trends.

Q: What happens to BET batteries after they’re no longer suitable for trucks?

One of the most promising aspects of BETs is that their batteries have valuable “second-life” applications. While a battery may no longer be suitable for a truck after reaching 80% state-of-health (typically at around 5-7 years in operation), it can still be valuable for stationary energy storage applications. Companies like Connected Energy, Moment Energy, and CALSTART-member Zenobē are already building successful business models around repurposing these batteries for grid storage, renewable energy integration, and other applications.

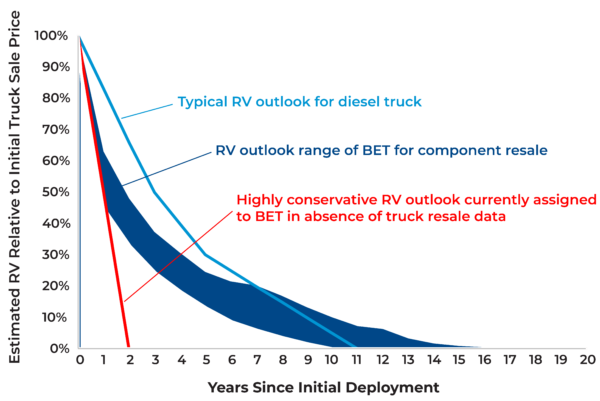

Q: How does the residual value of BET components compare to diesel trucks?

According to CALSTART’s financial modeling, BET components together retain 15-25% of the truck’s initial value by Year 5. This is competitive with diesel trucks, which typically retain around 30% of their value at the same point. Moreover, BETs often retain higher residual value compared to diesel trucks after the 8-year mark, largely due to the ongoing value of their batteries in second-life applications.

Benchmarking BET Residual Value (RV) With Component Resale Value

Source: Battery-Electric Truck Component Resale Highlights Residual Value Upside, 2024

Q: Isn’t the component-based method novel and untested, considering diesel truck residual values are usually benchmarked to resale prices of the entire vehicle?

While this approach differs from traditional benchmarking for diesel truck residual value, there is already strong validation through real-world implementations. Companies like Zenobē, Moment Energy, and Connected Energy are demonstrating concrete demand for used BET components, particularly batteries, through numerous successful projects on the ground right now. For example, Zenobe’s stationary battery storage product called the Powerskid, a self-contained system with 160 kilowatt-hours worth of second-life batteries, has been deployed in projects as large as 1.4 megawatt-hours or equal to roughly 10 electric transit bus batteries.

Diesel trucks are typically valued based on whole-vehicle resale prices. The component-based approach for BETs establishes a minimum value floor—if BETs end up reselling as complete vehicles at higher prices than this component-based benchmark, that’s pure upside that would make financing even more attractive. In other words, this benchmark tells us that BET residual values will be at least as high as the cumulative value of their used components, with potential for better performance based on whole-vehicle resale prices as that market develops.

Q: What are the implications for fleet operators and policymakers?

For fleet operators, this component-based approach to residual value could make BET financing much more affordable. Lenders who understand the retained value in BET components can offer better terms, translating to lower monthly lease or financing payments for fleets.

For policymakers, this suggests an opportunity to structure incentives differently. Rather than only offering upfront purchase vouchers, incentive program implementers might consider residual value guarantees or incentives for used BET components. This approach could make BETs more affordable while simultaneously helping develop a robust secondary market.

Q: What’s the market potential for second-life BET batteries?

The market opportunity is substantial. Analysis from McKinsey shows that the supply of second-life truck, bus, and vehicle batteries suitable for stationary applications could exceed 30 gigawatt-hours per year by 2030 in the United States alone. Moreover, repurposing BET batteries can help achieve energy resilience and reduce battery imports, a crucial value proposition during a period of high U.S. import tariffs. This translates to a market opportunity of roughly $2-2.5 billion, demonstrating significant value retention potential for BET batteries.

About Innovative Financing:

CALSTART’s Innovative Financing Toolkit features innovative financing knowledge products to offer actionable insights for green banks, investors, philanthropic foundations, and financial institutions to de-risk investment in the zero-emission vehicle (ZEV) sector and improve the economic viability of ZEVs.

About the Author:

Kabir Nadkarni serves as CALSTART’s EV Industry Assessment Specialist. His work focuses on identifying investment barriers facing the zero-emission transportation sector and stewarding scalable financing solutions in partnership with CALSTART’s member companies. Kabir is available for media interviews with journalists, speaking opportunities at investor conferences, and individual consultation with investors.

Interested in booking Kabir for interviews and/or speaking engagements? Contact Media Manager Jennifer Smith: jsmith@calstart.org.

About CALSTART:

A mission-driven industry organization focused on transportation decarbonization and clean air for all, CALSTART has offices in New York, Michigan, Colorado, California, Florida, and Europe. CALSTART is uniquely positioned to build the national clean transportation industry by working closely with its 285 member companies and building on the lessons learned from the major programs it manages for the State of California. CALSTART manages more than $1 billion in vehicle incentive and technical assistance programs in the United States and is leading a global effort to build the zero-emission commercial vehicle market.